By Amy Jeary

Global supply chain disruptions and evolving trade policies, including potential new tariffs, are prompting medical device manufacturers to rethink sourcing strategies. As geopolitical uncertainties and regulatory shifts loom, companies are increasingly turning to nearshoring—moving production closer to home—to reduce lead times, improve resilience, and navigate potential cost increases more effectively.

Why Medical Device Manufacturers Are Nearshoring

1. Strengthening Supply Chains

The COVID-19 pandemic exposed vulnerabilities in global supply chains, with shipping delays and material shortages disrupting production. Nearshoring shortens supply chains, reduces reliance on global logistics, and enables faster market responses.

2. Faster Lead Times

Nearshoring significantly reduces shipping times, enabling companies to react quickly to demand fluctuations, regulatory changes, and urgent medical needs—critical for high-demand devices like diagnostic equipment and surgical instruments.

3. Cost and Regulatory Benefits

Although Far East labor costs are lower, tariffs, freight expenses, and geopolitical risks reduce offshore sourcing appeal. Nearshoring minimizes these costs while simplifying compliance with FDA and EU regulations, reducing non-compliance risks and market entry delays.

4. Government Incentives

North American and European governments support nearshoring through tax breaks and infrastructure investments.

Companies Leading the Shift

- Several medical device manufacturers have expanded production in Mexico to lower logistics costs and improve access to North American markets.

- Others have increased nearshore production to enhance speed-to-market for critical healthcare products.

- Some companies are investing in regionalized manufacturing to mitigate global supply chain risks and improve operational efficiency.

The Role of the Dominican Republic in Nearshoring

For companies with manufacturing facilities in the Dominican Republic, nearshoring offers even greater advantages. The country provides proximity to North American markets, a well-established medical device manufacturing sector, and duty-free trade benefits under CAFTA-DR. Additionally, the skilled workforce and strong regulatory alignment with U.S. standards make it a strategic location for companies looking to enhance supply chain resilience while maintaining high-quality production standards.

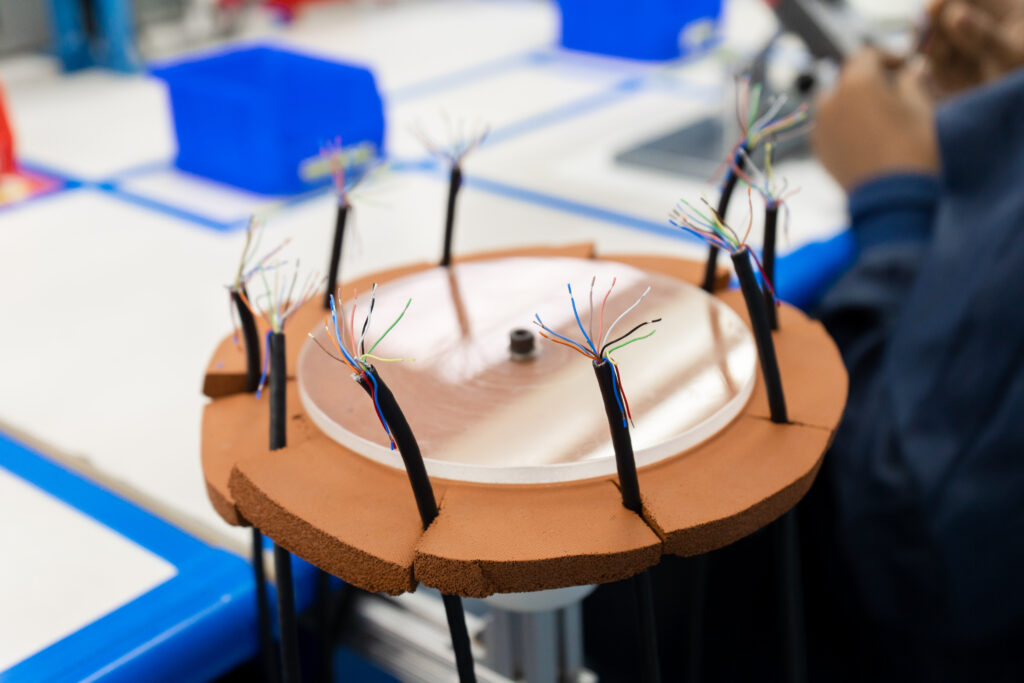

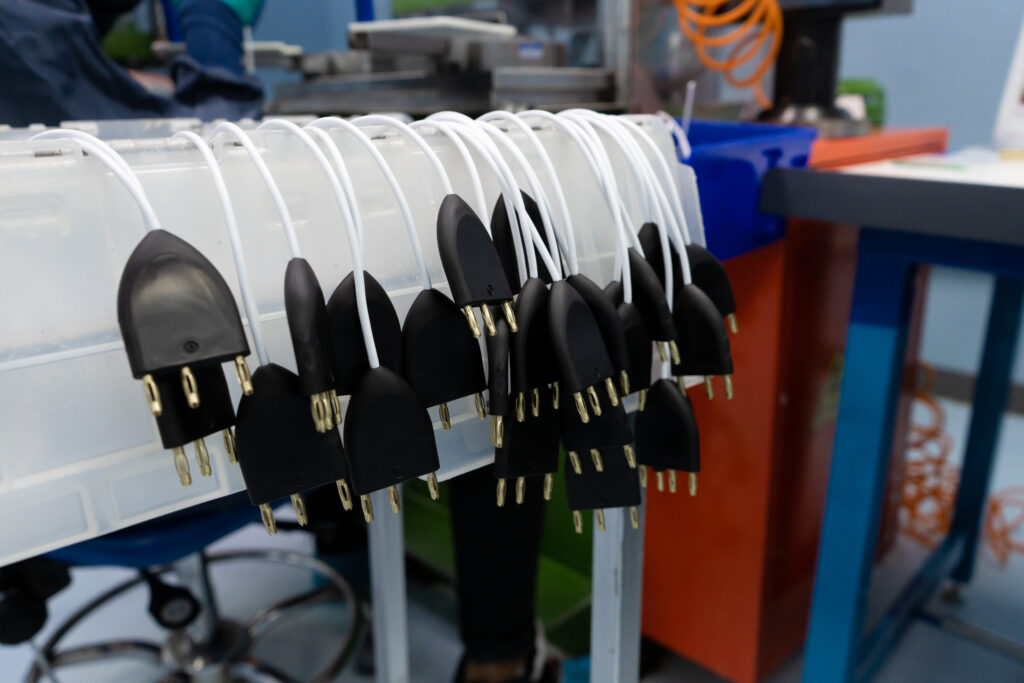

The Role of Nissha Medical Technologies’ Dominican Republic Facility

Nissha’s own Dominican Republic facility has become a powerhouse our manufacturing due to:

- Industry Growth: 9 of the top 30 global medical OEMs operate in the country, employing approximately 25,000 people.

- Foreign Investment: 90% of the market is driven by foreign direct investment, with accumulated investments reaching $897 million as of 2017.

- Export Strength: The country exports $1.75 billion in medical devices annually, with 20% growth over the past five years.

- Trade Advantages: Free trade agreements with the U.S. (DR-CAFTA) and Europe (CARIFORUM) provide cost savings and streamlined customs clearance at manufacturing sites.

- Infrastructure Support: Industrial parks equipped with fiber optic connectivity and dedicated electrical substations ensure reliable production environments.

At Nissha Medical Technologies’ Dominican Republic facility, we leverage these advantages to provide efficient, high-quality manufacturing solutions that help our partners optimize costs, reduce lead times, and navigate evolving global supply chain challenges.

Nearshoring is now a strategic necessity, enhancing resilience, agility, and compliance. As supply chain complexities grow, companies investing in nearshoring today will gain a competitive edge in the evolving global market.